By Shari Valenta

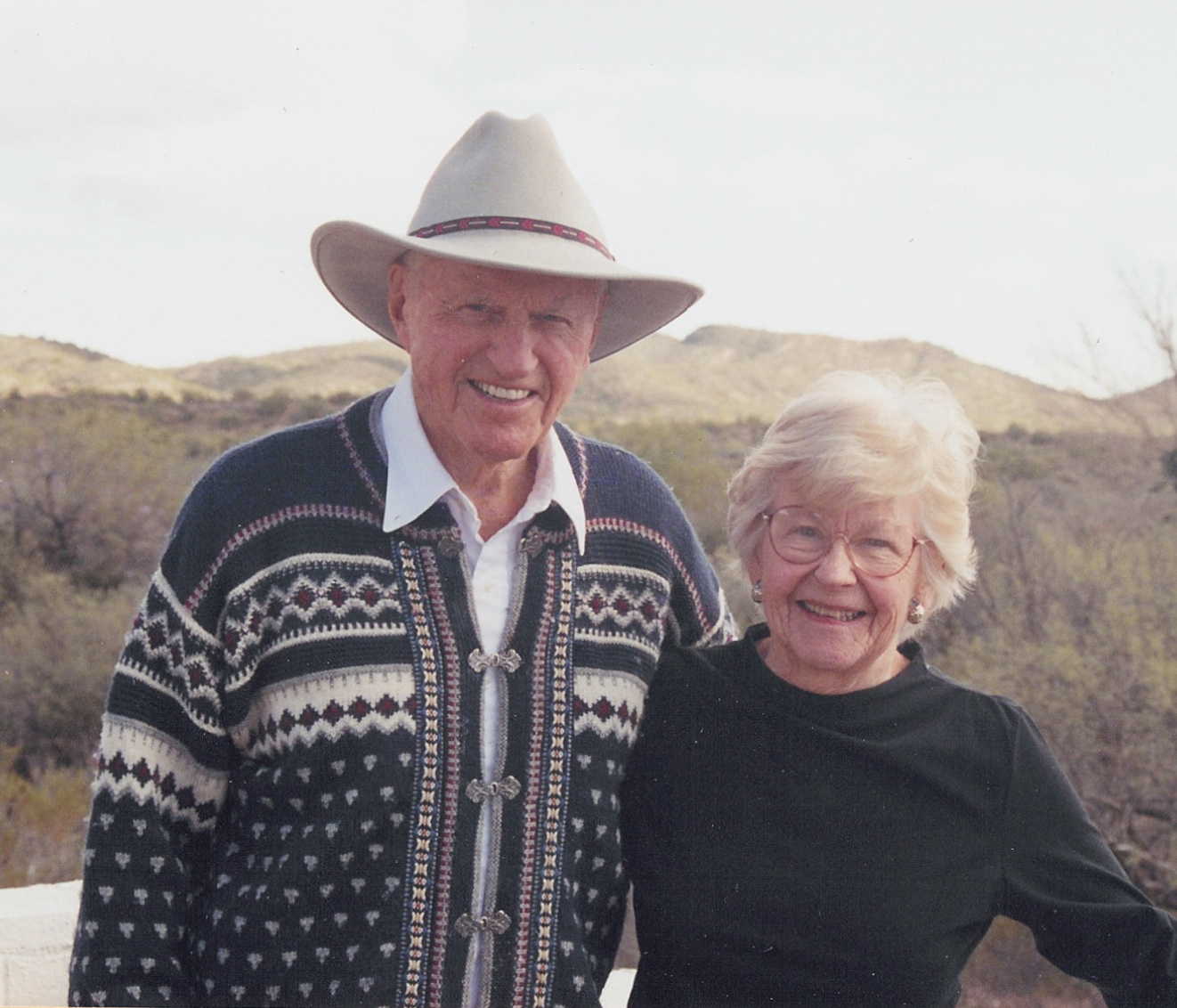

Financial planner Robert Thomas of AIG SunAmerica Securities, a part-time pilot, poses in front a collection of his hobbies at his office in Centennial. In addition to flying he enjoys photography and scuba diving.

“In 2006, at the stroke of midnight, every 10 seconds for the next 15 years there will be another individual turning age 60 of the 75 million baby boomers nationally,” warns financial advisor Robert Thomas, of AIG SunAmerica Securities.

That’s why he believes the time is now to start managing an investment portfolio. Thomas is a certified financial planner who helps high-end individuals build wealth as well as young people just starting to build their 401(k) and IRA.

Thomas is the head of his AIG Advisor Group, a division of American International Group, which is among the industry’s largest groups of independent financial advisors. The AIG Advisor Group brings together over 9,000 representatives at six broker-dealers throughout the United States. AIG SunAmerica Securities is one of them. They offer financial advice to customers and an array of investment products. Variable annuities, fixed annuities and mutual funds are some of the products available. Investment advisors can create a long-term financial plan to help a client find out if they’re on track in their retirement goals.

Thomas enjoys constructing strategies to make your income grow and seems to want to help everyone get a fair deal. You get the feeling he would hand out advice about trading stock or choosing insurance annuities, even if he weren’t doing it professionally.

“I was always interested in what was going on in the stock market,” recalled Thomas. “I started out in the late 1980s helping friends invest. Then, I went to the College of Financial Planning in Denver where I received my certificate in financial planning. I’ve been doing that professionally for about five years.”

Thomas is currently working on a plan for some friends that are retired. While many people would yawn and sigh over the endless numbers and figures, he’s happy and upbeat while explaining what it all means.

“One of the key features of this portfolio its very low standard deviation,” explains Thomas. “Standard deviation is (a margin of error and therefore) a major risk. The S&P 500 right now has a standard deviation of 15.4 percent and the standard deviation for this portfolio is about 5.5 percent. It’s a concept that I’ve been developing for about two years. It’s about one-third the risk of a normal portfolio. The strength of this plan lowers the volatility to a point where I don’t have to worry about what the stock market’s doing. I can sleep at night knowing my assets of my clients are safe.”

Thomas, who was once an Air Force pilot and still works as a flight captain for United Airlines part-time, also helps people in the aviation community. When he’s not flying or crunching numbers, he gives back to the community with his involvement in a nonprofit group called the Society for Financial Awareness. Thomas is the president of the Denver chapter that is comprised of various financial professionals such as CPAs, estate planning attorneys, financial planners, insurance professionals, realtors, wellness professionals, mortgage brokers, and other specialized persons. These volunteers provide financial education to various individuals and organizations at no charge.

And you could say Thomas helps the “little people.” He’s currently helping his grandson invest with insurance. Most people think of insurance as a means to protect themselves, but insurance can also be a way to save money.

“I’m using a non-traditional use of insurance products as a gift for my little grandson, born earlier this month,” said Thomas. “In six months we’ll fully fund an insurance program for him before it becomes a MEC (modified endowment contract) because you can’t over-fund insurance. Then, we’ll put that into a universal life policy and let it grow until he’s 18 years old.”

He said that will pay for his grandson’s college.

“What we’ll do is a tax-free loan out of the insurance product or if he doesn’t need college funding, the funds can grow until he’s 65,” he said. “There’ll be six or seven million dollars in there to fund his retirement! I find insurance products work extremely well if a person has plenty of time to plan for it.”

Thomas has many creative ideas to save or build wealth or create a portfolio with assets that compliment one another.

AIG SunAmerica Securities, Inc. is located on 6428 S. Quebec St. Consultations are by appointment 8:00 a.m. – 5:00 p.m., Mon. – Fri.

For more information about AIG SunAmerica Securities, call 720-482-0225. To learn more about the Society for Financial Awareness, visit [http://www.sofausa.org].