By Karen Di Piazza

Airbus Chair T. Allan McArtor says sales have gone from 18 percent of new aircraft orders in 1995 to 54 percent in 2004.

Airbus, an EADS joint company with headquarters in Toulouse, France, joined the commercial aircraft market in 1972. Back then, said T. Allan McArtor, chair of Airbus North America Holdings, Inc., nobody thought the company could compete.

“People snickered, and some outright laughed, but looking back, it’s easy to understand why,” McArtor said. “This upstart was taking on business icons—Boeing, and in those days, other formidable competitors like Douglas Aircraft and Lockheed.”

As recently as 1995, Airbus had only 18 percent of new aircraft orders, compared with 82 percent for Boeing and McDonnell Douglas. In 2004, though, Airbus had a 54 percent market share, with worldwide sales in 2004 in excess of $27 billion.

McArtor said they became the world’s leading aircraft manufacturer by listening to what the world’s airlines wanted—and what they didn’t want.

“They didn’t want another 777 stretch aircraft,” he said. “They wanted more modern, advanced aircraft with technology meeting their needs.”

Over time, said McArtor, Airbus “invented the wide-body, twin-engine, twin aisle aircraft,” and, “escaped a few near-death experiences.”

Airbus North America, with headquarters in Herndon, Va., is the parent of Airbus North American Sales, Inc. and Airbus North America Customer Services, Inc. in Virginia, plus Airbus North America Engineering in Wichita, Kan. The company’s functions in North America include marketing and sales support for airlines and other customers, as well as product and technical support and training for pilots, flight attendants and maintenance specialists.

Airbus aircraft are increasingly popular among North American airlines and their passengers. JetBlue, for example, operates an all-Airbus A320 fleet, making it one of America’s most popular low-cost airlines, winning a loyal passenger base with leather seats and live satellite television with DIRECTV programming. Frontier Airlines also became an all-Airbus fleet, and was the world’s first operator to use the A318 when it launched the shortened-fuselage version in the summer of 2003.

Other passenger airlines operating Airbus aircraft include Air Canada, America West, Northwest, United Airlines, US Airways, American Airlines, Blue Moon Aviation, Skyservice, Ryan International Airlines, Air Transat and Tradewinds Airlines.

Some of the company’s biggest customers, though, come from leasing companies, such as the International Lease Finance Corporation, which has more than 580 Airbus aircraft on order. Other leasing companies include GECAS, CIT Group, GATX/CL Air and Boullioun Aviation Services. The company’s freight, cargo and express package customers include Federal Express, United Parcel Service, DHL Airways, Express.Net Airlines and ASTAR Air Cargo.

All Airbus aircraft versions—the A300, A310, A318, A319, A320, A321, A330, A340 and the A380—are in operation or on order by North American customers. A distinctive Airbus quality is its “common cockpit” fly-by-wire concept, which McArtor said has “proven to be one helluva competitive advantage.” He said that this commonality, shared across the Airbus family, led to significant cost savings in crew training and greater scheduling flexibility in mixed/short and long/haul operations.

A homerun: the A380

When McArtor talks about the A380, the world’s first double-deck passenger jet, scheduled to enter service next year, you can hear the excitement in his voice.

“The passenger version is just around the corner,” he said. “Singapore Airlines will be the first commercial carrier to enter service with the A380 in the second quarter of 2006.”

As well, Emirates Airline in the Gulf region ordered 45 A380s, adding to its $30 billion fleet expansion.

“The A380 has been the most successful initial launch of any airplane in the world,” said McArtor. “We have 154 firm orders for the A380; that’s cash on the barrelhead!”

He said the A380 would make it possible for passengers to fly on long-range flights such as Paris to Asia, or Memphis to Paris.

“Actually, with a little bit of a payload penalty, you can fly nonstop from Asia to Memphis,” he said. “That’s the whole idea; you can bypass some of the other technical stops that you were required to make before. It’s not a matter that you even have a choice; if you’re going from Sydney to London, you’re going from a hub to another hub. When you do that, you want an airplane that has creature comforts, and the operator wants it to be fuel efficient, quiet and with low emissions. You and I aren’t going to get in the A380 and fly Chicago to Dallas because that’s not its market. But Chicago to Hong Kong, that’s another deal.”

He said the A380 is a homerun for cargo/freight operators, such as FedEx and UPS.

“Fred Smith at FedEx is a very good friend of mine,” McArtor said. “I introduced him to Airbus back when I was running the FedEx airline. Back then, we were approached by Airbus for a freighter.”

McArtor and his team negotiated the first Airbus freighter acquisition for FedEx in the early 1990s. He said FedEx was one of the first companies to order the A380.

“We’re launching the freighter and the passenger airplane at the same time,” he said. “The freighter will lag by two years, so we’re looking at 2008. FedEx is our first freighter customer; it’s basically optimized as a containerized freighter.”

He said that UPS signed up for 10 A380s as well.

“When operators like FedEx or UPS are flying containerized freight, and your weight is seven to 10 pounds per cubic foot or so, you have almost a perfect cube-to-weight ratio with the A380,” he said. “You have three main decks of cargo you can load right to the gills and fly 150 tons 5,600 nautical miles. That’s a big deal; that’s a game changer! It will save people a lot of money, it will improve service, and it’ll allow pull times out of Asia to be later. Order fulfillment can be later and still make service commitments. It will be a very significant airplane for the cargo guy.”

Other A380 benefits

McArtor laughed at some of the ridiculous things people say about the A380, such as, “You can’t load 500 people through one boarding door at the airport terminal,” or that baggage claim won’t be able to handle it.

“This is just urban myth stuff,” he laughed. “People say, ‘Think about all those people down at baggage claim.’ Well, people are down there all the time with four different 747 flights that just came in together. Do they need to improve it? Yeah, probably so, but it’s not because of the 380; it’s just because baggage claim needs to improve.”

He said Singapore Airlines sees the A380 as a huge benefit. Instead of flying two 747s into LAX 30 minutes apart from one another, they can fly one plane, save a lot of fuel and provide better service.

“People want to arrive and depart basically at the same time,” he said. “You already have two 747s trying to load, de-plane and do baggage claim right now, so it’s not as big a deal. And remember, when the 747 was introduced that was over twice as many people as we were used to flying on DC-8s or 707s. We’re talking about 35 to 40 percent more people here. It’s not such a big leap.”

He said that Airbus started designing the A380 15 years ago, with input from the airlines, so they’re fully aware of its benefits.

“The A380 will definitely help with congestion, too,” he said. “You have two kinds of congestion; one, in the terminal area itself, is people congestion. The other is airplane congestion. London Heathrow, for example, told us that with the addition of the A380, they could move ten million more people per year through that airport without any increase in the number of airplane movements. That’s a big deal; that’s a big productivity thing for them because there’s only so much concrete and only so much airspace that exists right now.”

McArtor said that until the world starts building more major airports, we have to live with what we have.

“We’re going to have to make better use of existing facilities—terminals and runways— because all forecasts—not just that of Airbus, but also Boeing’s and the FAA’s—predict that we’re going to double and triple the enplanements over the next 20 years,” he said.

With a little help, the first A380 is en route to Airbus’ flight test center at Toulouse-Blagnac International Airport.

McArtor said the A380 would be a similar performing airplane in terms of speed and altitude, abiding with typical wide-body separation standards, and that the wake vortex of the A380 is designed not to be any more officious than other heavy airplanes that are flying. It’s a large plane; at 300 feet, the wingspan basically reaches from goal line to goal line on a football field.

The number of passengers or seats in the airplane is an airline-specific decision. For instance, McArtor said that when Singapore introduces the airplane it would probably only have 400-plus seats, because they will have quite a bit of first-class/ business-class seats.

“Nominally, we use a term of 555 seats as a pre-class configuration, as sort of a bench-line, first class/business class and coach,” he said. “Technically, the number of seats that would be permitted in the airplane, for which the airplane would be certificated, is permitted by the number of exits that you have. I believe the maximum seating could be 834 plus 19 crew seats. We’ll demonstrate and certificate the airplane for that, but I don’t think you’re going to see any airline do that for a long, long time.”

What about the future, say 20 years from now: will there be a larger version of the A380?

“Well, I think there will be a stretch A380,” McArtor said. “We’ll probably stretch the airplane, but I don’t see a bigger airplane than the 380 or a different airplane, in order for it to be larger. It’s not that we probably couldn’t build bigger airplanes, but there’s a limit to how big you want an airplane to be at an airport, and the wingspan.”

The production rate starting off for the A380 will be one a month, and then production will build up to four aircraft a month. That’s as far as McArtor can forecast production right now. It’s too early in the game to know what’s possible as Airbus gains orders.

Nevertheless, Toulouse, France will continue as the company’s final assembly facility, with completed wings, fuselage sections and tails brought in by ocean barge, rail or road.

More myths

Many skeptics of the A380 have said, “That plane is too big for our airport!”

“This is a PR myth; most of these airports claim they need a requirement for a capitol improvement program,” McArtor said. “They want to improve concessions, retail areas, baggage claim areas, security and rental car facilities, claiming it’s to get ready for the A380. That’s the reason they give for trying to push capitol programs. Really, the major airports have little to do to ‘get ready for the 380.’ They claim they have to fill up the taxi, the turn-radius of the taxiways and all to accommodate the A380. Yes, but you also need to do that to accommodate the triple 7 or the A340—any big airplane with a big turning radius.”

McArtor said the A380 actually requires less pavement loading than the 777 or the 747.

“It weighs more but it’s spread out over 20 main landing gear, so the actual footprint is less pavement loading than these other airplanes,” he said. “It requires less runway to take off and less runway to land than it does a 747-400. Part of the urban myth is that the A380 will go right through the pavement. The highest pavement loading of airplanes around our system is the old 727; you have to worry about more crumbling of the pavement. It’s not weight; it’s the point load on any given gear that creates the pavement stress.”

McArtor said that years ago Airbus and Boeing studied co-building a big airplane.

“We went down that road for a few years, but Boeing, thinking that Airbus wouldn’t do it on its own, spread off and said they were sticking with its 777,” he said. “They stretched it, because at the time they dominated that large airplane market. I think they were stunned to find that Airbus said, ‘Fine, we’ll build a big airplane on our own.’ I don’t think Boeing believed Airbus would ever carry through on that. Guess what? The airlines of the world said that they didn’t want a stretched triple 7. They wanted an aircraft with new technology, so Boeing found themselves suddenly not in that market at all.”

He also discredits recent media reports that said Airbus was waiting for the Air/France Boeing romance to sour. The reports referred to Air France becoming Boeing’s launch customer for its 777 freighter, replacing its 747-200s. It was mentioned that the A380 freighter would be flying in 2008, and that the aircraft is capable of carrying 50 percent more cargo than the 777 over the same distance. The report said the A380’s four engines versus Boeing’s two would be more costly to operate.

“That’s not accurate,” McArtor said. “Those four engines are derated with respect to the two on the 777. A fully-loaded 777 freighter has to meet single-engine climb requirements. Thrust requirements on those engines would require very high ratings and very high maintenance costs. Maybe the public doesn’t understand the economics of our business, but the operators certainly do.”

McArtor says Air France will continue to grow, and Airbus will get its share of business.

“They’re a great customer of ours,” he said. “If they want to buy a Boeing product, they will. If our airplane is better than Boeing’s, it will sell, and if not, it won’t sell.”

McArtor confirmed that Air France has more Boeing aircraft in its fleet than Airbus.

“What people fail to realize is that the airlines of the world want two healthy airframe manufacturers,” he said. “They’re not going to buy all Boeing or all Airbus; they’ll have a balance of them, and that’s the way the marketplace is going to be in the future.”

U.S./EU subsidy talks

Despite the celebration of the A380 launch and enthusiasm due to the design phase of the A350, a long-range jet due in 2010, a looming trade dispute before the World Trade Organization is foremost on McArtor’s mind.

McArtor, named chair in June 2001, oversees the activities of Airbus in the U.S. and Canada in several areas, including governmental affairs. While giving a speech at the International Aviation Club, Washington, D.C., in March of this year, he called for a solution and a settlement of sinking U.S./European Union trade talks.

On January 11, the U.S./EU decided upon a 90-day period to negotiate phasing out billions of subsidies to both Airbus and Boeing, and to halt subsidizing to both plane makers during the standstill ending April 11. The decision to talk and not sue, which the U.S. threatened in October after it withdrew from the 1992 agreement, has all but gone downhill as of going to press, days before the April 11 deadline.

McArtor wants people to understand the views of Airbus on U.S./EU talks breaking down. He agrees that if one could simplify reasons for negotiations falling short, it would be that the way Europe and the U.S. supports its aerospace industry is “apples and oranges,” and to think all issues can be settled in a 90-day window isn’t realistic.

When Airbus Chair T. Allan McArtor talks about the A380, the world’s first double-deck passenger jet, scheduled to enter service next year, you can hear the excitement in his voice.

“You have to go back to the 1992 agreement, which was an attempt to create a balance between the method by which European countries supported its aerospace industry and the methods in which the U.S. supported its aerospace industry,” he said. “It was a good attempt, but not as effective as it could have been, and it certainly didn’t have the level of trust on both sides of the Atlantic that it required to be effective.”

He said there’s a lot of speculation as to why the U.S. withdrew from the 1992 agreement. One theory is that Boeing was pushing for WTO litigation in an effort to slow down Airbus in the marketplace.

“The legal theory on that is you couldn’t do that if the 1992 agreement was still in effect,” he said. “Therefore, there’s a lot of pressure by Boeing and its lobbyists, and a former trade official, to withdraw from the 1992 trade agreement.”

He said Boeing and the U.S. had a right to withdraw, and for all practical purposes, the agreement is dead. McArtor has another theory; Boeing withdrew because they recognized that accepting Washington state reduction subsidies was prohibited. Further, he said that Boeing was out of bounds with respect to the 1992 agreement in that it has a risk-sharing partnership with Japan, which indirectly was considered as aid to Boeing under the agreement.

“It’s a theory only, but maybe they wanted out of the agreement so they wouldn’t be caught for speeding, themselves,” he said.

Fair negotiations

McArtor believes that the U.S./EU negotiations should focus on rebalancing “permitted government” supports because a trade war should be the last thing ever considered. He also believes it’s impractical to think that somehow the U.S. is going to forego its NASA civil aeronautics developmental program, or its R&D programs.

“What should be developed are acceptable limits—which are transparent, reportable and enforceable—of these permitted government supports,” he said. “That way, we can have an industry and new aircraft programs that will continually have progressive technological advancements. Otherwise, we’re going to become a very mediocre, incrementally-improved civil aviation industry. That’s not good for airlines or the supply chain or anything else.”

For instance, he points out that Boeing wouldn’t have a composite fuselage program had it not been for NASA’s advance subsonic airplane study, nor would they have composite wing technology had it not been for NASA. In fact, he said Boeing wouldn’t have its 777 airplane had it not been for NASA Langley development on many of the core technologies for that aircraft.

McArtor said he’s not saying this support is inappropriate.

“It’s a fact; it’s the way it’s done on this side of the Atlantic,” he explained. “Boeing answers this using winglet technology by NASA, and says that Airbus benefited from it. On the European side, member-state countries give repayable loans to Airbus for specific development programs. Not all of the programs; only three of the last eight new aircraft models took advantage of that system.”

The imbalance, he said, is that Airbus pays competitive interest rates on such loans, plus they pay royalty on each aircraft sold.

“In other words, the loan is paid off with interest and a royalty continues, which is about 400 million euros a year paid in royalties,” he said. “The U.K. government has doubled its money on its investment in the A320 program and has succeeded in preserving about 22,000 jobs in the U.K. That’s a good deal for the U.K., which provides some risk-offset for Airbus. The difficultly that’s going on right now is the question of what should continue to be government supports.

“What we’re experiencing, though, is we have a bilateral discussion with a unilateral solution. In other words, the U.S. is saying ‘We want to eliminate all repayable launch aid for Airbus.’ The U.S. isn’t saying to ‘reduce it.’ The U.S. wants to eliminate all of it. But when Europe asks the U.S. ‘What are you willing to give up?’ they come back with, ‘That’s not part of the discussion,’ even though last fall the U.S. said they were willing to put ‘everything’ on the table. In fact, Mr. Stonecipher (Harry Stonecipher, former Boeing president and CEO) said that. He said he would ‘up the rhetoric’ and ‘put everything on the table,’ but Boeing hasn’t done that. They haven’t put everything on the table.”

A trade war vs. negotiations

McArtor said he’s aware that the American press has misrepresented the facts and has reported untruths blaming Europe for stymied U.S./EU negotiations.

“That’s exactly what they’re reporting, and Boeing is spending a great deal of money, with a great deal of people, trying to influence opinion makers, including the press, that somehow this is a European problem,” he said. “Europe has been compliant with its obligations under the 1992 agreement, to the letter of the law. I think Boeing understands that. I don’t think it’s an Airbus problem or a Europe problem. Frankly, I think it’s a refection of a commercial strategy—a competitiveness issue, if you will—on the part of Boeing that hasn’t been working very well.”

He said although U.S./EU talks haven’t been as successful as he had hoped, partly because 90 days isn’t enough time, he’s enthusiastic about a possible basic framework of understanding. The April 11 deadline doesn’t mean that both sides can’t continue talks, but it does permit the U.S. and Europe to request a panel and go back to the WTO litigation route, which both sides filed before the 90-day standstill period.

“Everybody I talk to—especially everybody in the supply chain that supplies both Airbus and Boeing—believes a negotiated settlement is in the best interest of the industry,” he said. “Everybody believes that a trade war with Europe is a very bad idea. It has enormous spillover and probably dozens of unintended consequences. We have over $400 billion in transatlantic trade right now. Europe and the U.S. are the largest partners in the world. Why would we want to jeopardize that?”

McArtor said it’s very likely that without the protective umbrella of the 1992 trade agreement, both Europe and the U.S. could be found to be out of bounds with respect to the WTO subsidy rules.

“What would we get? An Embraer/Bombardier both of you are guilty standoff?” he asked. “We’d have to negotiate a settlement anyway, so why not do that now?”

Instead of immediate litigation, McArtor suggested both the U.S. and Europe should have a “cooling off” period, which would give Rob Portman, who was designated U.S. trade representative in March, time to get into the job and sit down with Peter Mandelson, the European Union’s new trade commissioner.

“This would allow for long-term agreements, taking the place of the 1992 agreement,” he said.

What’s the bottom line risk for the future of Airbus? If talks remain deadlocked, would litigation stop the company’s production of new aircraft, namely its A350, because it’s in a “design phase?”

“No, it wouldn’t stop our production, and this is what industry analysts have a very difficult time trying to figure out,” he said. “If Boeing is trying to stop the A350 so it cannot compete with the 787, which they’ve been outspoken about doing, going to the WTO won’t accomplish that.”

McArtor says that if Boeing were to file a complaint with the WTO to try to stop the A350’s production, it could encourage pervious launch aid loans in assisting the finance of the A350 program.

“But the whole WTO process will probably take four to five years,” he said. “By then, the A350 will be well down the road. It’s all perspective; the WTO rulings rule on what you can or can’t do in the ‘future,’ not what you’ve done in the past. Decisions by the WTO are effective as of the date of decision, not the date of filing a complaint. Therefore, this wouldn’t stop the A350 at all.”

He said he was hopeful that talks will prevail and include the main issue of “balancing the risk sharing that’s available to both Boeing and Airbus.”

He said specifically the 787 and the risk sharing that’s available through Boeing, through its relationship and structure with Japan, and through its structure with the state of Washington and other states, was out of balance with the A350. He believes these issues, as well as indirect subsides from Boeing’s defense contracts, NASA and the Pentagon’s R&D, must be fairly negotiated and balanced. Otherwise, he said it wouldn’t be fair or balanced to expect Airbus to abandon its government repayable aid launch.

This is exactly what’s being discussed,” he said. “We need to balance these types of aid, which I think was attempted in 1992. I think that’s what we have to do again—sit down without a gun to your head, and let the two airplanes that are competing with each other get funded and get developed. Then Europe, the U.S. and other third-party countries can sit down and define what are acceptable and feasible government supports.”

Airbus supports over 140,000 American jobs

McArtor said he agrees that most Americans have believed negative marketing campaigns aimed at Airbus portraying them “as the mean foreign, subsidy monster that’s taking jobs away from Boeing.”

“They also say, ‘Oh, you have to buy U.S. products,’ but Boeing is no more a U.S. product than Airbus is,” he said. “We’re both international companies and we have suppliers literally from around the globe.”

Unfortunately, he said, there’s a strong, nationalistic sense of American jobs versus European jobs entering the debate.

“Airbus has provided 140,000 American jobs and we spend $6.9 billion per year in the U.S. with American companies in 40 states, but that’s growing as we increase our production and our participation in U.S. aerospace,” he said. “Airbus spends more in the U.S. than it does in any other country, including all of the European countries. As an international company, we’re very proud of our relationship here in the U.S., so I get tired of hearing ‘You’re a French company; all those Seattle jobs went to France.’ That’s ridiculous.”

McArtor said that about 46 percent of parts, components and systems used to build Airbus aircraft in 2004 came from America. He said that in 2003 Airbus invested more money in R&D than all the divisions of The Boeing Company combined. In part, he said that was another reason for increased American jobs because it led to manufacturing cutting-edge aircraft.

“Airbus is the largest export customer to the U.S. aerospace industry,” he said. “In the last six years, plus or minus five or six percent, we’ve been delivering about 300 aircraft a year. We got where we are today through hard work, consistent investments, visionary design and by playing by the rules.”

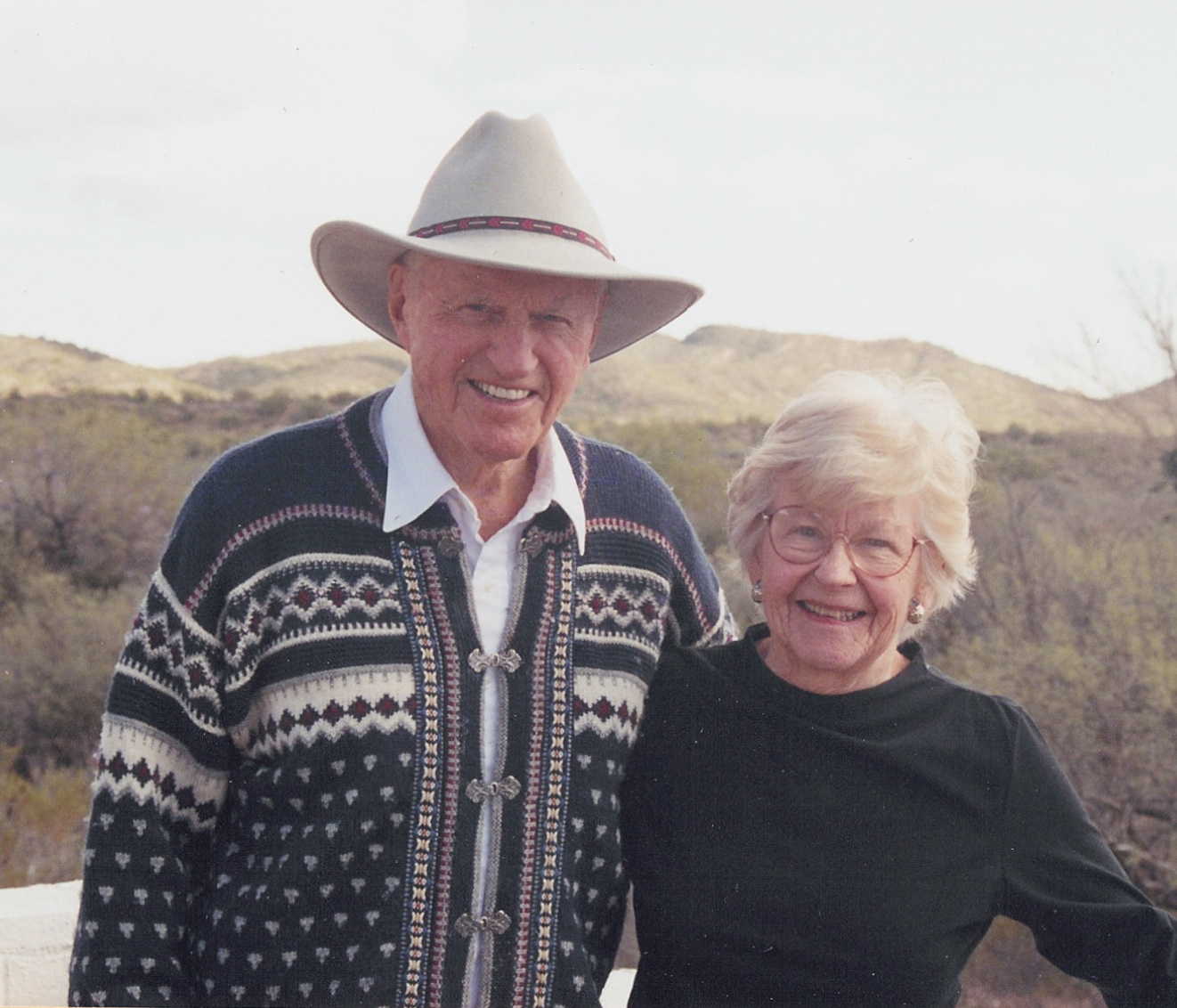

Allan McArtor

Allan McArtor is a member of Tau Beta Pi, the only engineering honor society representing the entire engineering profession. He recently became president of The Wings Club, N.Y., when Kenneth E. Gazzola, executive vice president/publisher of Aviation Week Group, a McGraw Hill Companies aviation magazine, passed the gavel to his successor, making it official.

The prestigious club was formed in New York City in May 1942, in the early days of World War II, when a number of America’s aviation leaders decided to band together to find suitable meeting places where they could gather to help chart the future course of aeronautics.

“The Wings Club soon became a rallying place to talk about the latest aircraft and flying techniques,” McArtor said.

McArtor said that Gazzola left the club in great shape, and that his agenda for this year is to build on the initiatives started by Gazzola and the board last year. He plans to increase membership, improve member communications and improve the value perception of club membership.

“I plan to host a dynamite dinner dance and silent auction in October of this year,” he said. “I want to continue the partnership with ISTAT and continue scholarship programs as well.”

McArtor hasn’t been in the pilot’s seat lately, but he is a pilot who continues to hold commercial, instrument and multi-engine ratings. Born July 3, 1942, in St. Louis, Mo., he served in the U.S. Air Force from 1960 to 1974. He graduated from the U.S. Air Force Academy, and maintains several friendships from the class of 1964.

“We called ourselves the ‘aging aviators’ for years. I think we should call ourselves the ‘ageless aviators’ now,” he laughed. “These are the guys I went to Vietnam with.”

Sporting Airbus’ new livery and customer logos, the A380, before its launch, was simply “project A3XX.”

McArtor’s former classmates include Steve Ritchie, the only U.S. Air Force pilot ace of the Vietnam War. McArtor, a highly decorated combat fighter pilot, said every day in that period offered a chance to do something you trained hard for, and to demonstrate whether you were any good at it.

“I’m not saying you didn’t scare yourself sometimes, or others didn’t scare you, but it was a combat environment; that’s why we were there,” he said. “I was flying the RF-4—the Phantom II. That was a hot airplane. It went fast; those two big engines made a lot noise.”

McArtor capped his Air Force career as a pilot with the U.S. Air Force Thunderbirds aerial demonstration team.

He continued his education at Arizona State University, earning an MS in 1971. During his freshman year, he met his future wife, Grace.

“We dated all the way through college and then got married,” he said.

McArtor’s resume includes a stint as partner and director of Delta International, Inc., from 1974-1979, followed by a position as senior vice president of the telecommunications division of Memphis, Tenn.-based Federal Express Corp. He served on the senior management team of Federal Express from 1979 to 1994, except for two years beginning in 1987, when President Reagan appointed him to serve as the administrator of the Federal Aviation Administration, Department of Transportation, succeeding Donald D. Engen.

During that time, McArtor was credited with helping to regain public confidence in air transportation in the U.S., while accelerating the modernization of air traffic control. He was also active in gaining increased FAA funding for ATC and other critical programs including Extended Twin Operations (ETOPS) and Traffic Collision Avoidance System (TCAS). In addition, McArtor created the standards for “aging aircraft” regulations and issued the industry’s Stage III noise regulations.

While at Federal Express, his responsibilities included oversight of maintenance, operation, training, scheduling and planning for the carrier’s global airline operations. He oversaw the successful merger of the Flying Tigers air cargo airline into the Federal Express operations, and the development of the long-range fleet plan, which first introduced Airbus A300-600R freighters.

While at FedEx, he flew the company’s corporate jets.

“Then, when I was at the FAA, I flew virtually everything from helicopters to tilt rotors to fighters to big airplanes,” he said. “I flew experimental airplanes; I flew everything that I could get my hands on.”

He laughingly says he keeps his medical current just in case anybody is foolish enough to let him fly their airplane.

“The last time I had the controls in my hand, really, was when I flew down to Kitty Hawk for the 100th anniversary of the powered flight celebration,” he said. “I flew with a fella that had a single-engine turboprop and he said, ‘You want to fly it?’ I said, ‘Sure, absolutely, never pass up a chance. It was a Socata.'”

Following his position at Federal Express, McArtor founded and served as chair and CEO of Legend Airlines, a regional airline based at Dallas Love Field. His son, Scott, was a co-founder and one of his key executives.

Scott isn’t an aviator, but McArtor’s other son, Andy, is a longtime pilot and cockpit resource management and human factors trainer. He previously worked for FedEx, before joining Tennessee-based iviation, an aviation services company founded by David Perdue, whom McArtor recently sponsored into The Wings Club.

McArtor said in respect to the last hundred years of powered flight, the industry has significantly advanced its aircraft with safer redundancy training, a key element to understanding aircraft and human capabilities.

“But as long as there’s a human in the loop, in many respects it’s still the weakest link that we have,” he said. “We have to do everything we possibly can to improve the human in the loop, which is what we do at Airbus.”

He said his son’s initiative in teaching CRM at iviation is exciting. He adds that Andy is a lot “smarter” than he was when he started in aviation, and that they share commonalities in CRM training.

“Andy enjoys that and he’s good at it,” he said. “But when the whole CRM initiative was still pretty new, when I was the FAA administrator, I won’t say I made the airlines do it. Let me just say I was encouraging all airlines to put it in place. There were a couple of airlines that had CRM, but we had one very horrible accident in 1987 that was a prime example of the need to have good CRM, so we set standards and created the oversight for that, which the airlines adopted.”

He said if there’s one area of aviation that requires CRM/human-factors training, it’s in the corporate jet environment.

Andy McArtor describes his father as a “man’s man” and a good father.

“He’s a compassionate person with a good sense of humor,” he said. “And he’s an honest person.”

As he reflects about their close relationship, he recalls a time when he was a child and he realized his father was literally larger than life.

“I was watching my dad fly with the Thunderbirds,” he said. “I was eating a peanut butter and jelly sandwich. Then, all of a sudden, there he was, so tall, with his shadow bigger than life on the tarmac. The next thing I knew, a voice way above my head was saying, ‘Hey, you’ve got you’re goop all over my boots!’ I was just a little kid who admired this giant of a man, and I still do admire him, even though I’m as tall as he is now.”