By Marilyn Noble

L to R: Landon Farley, Jim Saltz, Shelia Frank, Perry Rickel, Phyllis Deremiah, Ron Bergen and Tim Smith, the staff atCherry Creek Financial Group, delivers quick and easy service for all types of mortgage loans.

Cherry Creek Financial Group

While many Colorado companies are experiencing a slump in business that goes with the state’s cooled off economy, that’s not the case in the mortgage lending business. Even though real estate sales are a far cry from what they were just a couple of years ago, thousands of homeowners and investors are refinancing their mortgages to take advantage of interest rates that are lower than they’ve been in decades.

Cherry Creek Financial Group, founded by Perry Rickel and Landon Farley in 1996, has ridden the crest of both waves—the sales frenzy of the late 1990s and the current boom in refinancing.

According to Rickel, the company is successful because they make it as simple as possible for borrowers to complete what can be the biggest transactions of their lives.

“This is a relationship business,” he said. “While it’s possible to do the whole transaction over the phone, we like to meet with our clients face-to-face, so we can get to know them better and advise them on the loan products that will meet their needs.”

A company loan officer collects information in a phone interview before a client comes in the door, so the client knows what kind of paperwork to bring to the first meeting, and so the loan officer has some idea about how to structure the loan.

“Many times we’ll ask for more than we think we need, which goes back to the ‘under promise and over deliver’ philosophy,” said Rickel. “That alleviates the frustration for our clients of having to keep giving us more paperwork. Our goal is to make it as easy as possible.”

Because the underwriting is done in-house, most loans are approved in 24 hours, and are closed in about three weeks.

“That’s a little longer than we’d like right now because of the volume of our business,” said Rickel, “Ideally, our turn-around time is about 10 business days.”

While the company employs lots of different ways to attract new business, the best advertisement comes from existing clients. According to Rickel, “We get the majority of our business from previous clients. They see how easy it is to do what we do; they see the value and they come back to us. That shows we’re doing a good job.”

“I’ve met lots of friends who started with me as clients,” he added.

Another valuable referral resource is the local realtor community.

“Again, it goes back to the ease of doing business with us,” said Rickel. “We never have a problem meeting a contract date, and we focus on the money purchase side. If we need to, we’ll move those clients in front of those who are refinancing, because their timing is more critical.”

Although the company specializes in loans above the government’s Fannie Mae and Freddie Mac limits—currently $322,700—they can work with anyone.

“We don’t really have an ideal client,” said Rickel, “because all of our clients are good in one way or another. Even people with past credit problems are okay. Mostly we like to work with people who are well prepared for the process, attentive to our questions and deliver the information we need in a timely fashion.”

The company offers an extensive portfolio of loan products for first-time buyers, re-financers, investors, the self-employed and high net worth individuals. They have special expertise in putting together jumbo loan packages larger than a million dollars.

“Because there are very few outlets on the secondary market for those kind of loans, it’s critical that they be structured right the first time,” Rickel said. “We’re very good at doing that.”

The company can work with past bankruptcies, small credit dings and the client’s willingness to provide income verification. While most borrowers are happy to share all of their information, sometimes verifying income can be a problem. For the self-employed who have a large number of write-offs for tax purposes, or for high net worth individuals who may have a tax return that run dozens of pages, providing the necessary documentation can be difficult. While the borrower who is willing to provide all of the information may have more financing options, no-income-verification loans are an alternative for borrowers who need or want to go that route.

The two most critical pieces for any borrower are credit worthiness and loan-to-value on the property.

“The better the credit is, the better the interest rate will be, especially in a no-income verification scenario,” said Rickel.

For more information on Cherry Creek Financial Group’s mortgage lending services, call (303) 813-9118, or visit [http://www.mortgagemint.com].

Canaan Gallery

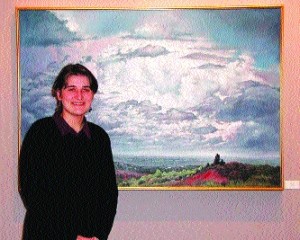

Deborah King, assistant director of Canaan Gallery in Southglenn Mall, with a landscape by Bob Simpich of Colorado Springs.

The Denver art scene is replete with galleries that present art in all kinds of media and spotlight the work of artists from around the world, but only one gallery in the metro area specializes in faith-based fine art. In fact, Canaan Gallery in Southglenn Mall is the largest gallery of its kind in the country.

The gallery displays 400 pieces of original art from more than 80 local and national artists who work in all styles and media, from abstract sculpture to traditional realistic watercolor and oil painting to jewelry.

“We have 6,000 square feet of the most beautiful art in town,” said Nancy Parker, gallery director. “Our quality and our setting certainly measure up with any of the local galleries.”

Many of the pieces in the gallery portray Judeo-Christian themes, but plenty of the works reflect the beauty of nature, such as large landscapes from Bob Simpich and watercolors by Lorraine Danzo, a graduate of the Pratt Institute. Simpich, best known for his work as a doll designer, is the owner of Simpich Dolls in Colorado Springs, a business that has been creating collectible Christmas dolls for over 50 years.

“Most people know him for the dolls,” said Parker, “but not many people realize that he’s also a very accomplished painter.”

The gallery also carries the original work of Suzy Schultz, whose illustrations grace the pages of “In Touch” and several other Christian magazines, as well as Joel Tanis, who specializes in whimsical interpretations of Bible stories for children. He’s well known for his illustrations in the New International Reader’s Version of the Bible for children.

According to Deborah King, assistant director, “We wanted to provide a place for artists to show all of their work, both religious and secular. They can say, ‘This is who I am as an artist.'”

“About 60 percent of our clientele doesn’t care if the work is religious; they just buy because it’s a piece they connect with,” said owner Tim Gonerka. “We have lots of first-time art buyers because the gallery is comfortable and accessible, but we also deal with lots of collectors because of our professionalism.”

Gonerka founded the gallery in 1998, after talking with an artist friend he hadn’t seen in years, who said he had given up painting religious subjects because he couldn’t find gallery representation. Gonerka saw an opportunity to fill a niche, since there were fewer than 10 galleries in the country that carried faith-based art. His first gallery was located in a small store at Orchard and University, and because the space was limited, they would hang work at area churches to reach a wider audience.

For the first three years, Gonerka ran the gallery by himself, but then began to add staff. King joined the gallery last October after receiving a degree in graphic design from Colorado Christian University, and Parker brings over 20 years of gallery experience in the western art Meccas of Scottsdale and Sedona. Two years ago, Gonerka moved the gallery to the upper level in Southglenn.

“This has been a good move for us,” he said. “It’s a much bigger space, and it’s easy to find. The larger space has allowed us to experiment with different things and show people what’s out there in the art community.”

Added Parker, “The mall has been wonderfully supportive. They seem to be really glad we’re here.”

Stepping through the door of the gallery provides a quiet and reflective respite from the hustle and bustle of the mall. The staff encourages people to come in and look, and ask questions if they feel the need.

“Mostly, we just want people to come in and see what we have,” said King.

Canaan Gallery will even provide free meeting space for groups or organizations. “We’ll work with anyone who’s looking for a pretty or inspiring place to have meetings,” said Parker. “We’ve hosted everybody from the Chamber of Commerce to Bible study groups.”

The gallery has a small classroom where adults can take classes in watercolor and oil painting, and children can learn about drawing, pastels and watercolor. The two-hour class sessions are offered once a week and are limited to six students so that each student receives one-on-one help from instructors Melissa Barrett and Sandra Stemmler, both professional art teachers.

Canaan Gallery is open from 10 a.m. to 7 p.m., Monday through Friday, 10 a.m. to 6 p.m., Saturday, and closed on Sunday. For information about meetings, classes or to inquire about specific artists represented in

the gallery, call (303) 794-6945.