On March 3, Encore FBO LLC, GTCR and Platform acquired Landmark’s airport services division from DAE. The company presently owns or manages 41 FBOs, including this base located at Los Angeles International Airport.

By Clayton Moore

In the early days of aviation, perceptive businessmen made decisions to stop chasing barnstormers across the country, forcing pilots to come to them for fuel, maintenance, repairs and other essential services. Past visionaries might’ve been shocked to discover what a hot commodity their businesses have become in the new century, where fixed base operations have become prime targets for investment, purchase and most recently, a wave of consolidation.

A new multimillion-dollar deal in March to acquire Landmark Aviation could be the pinnacle in a record-breaking arc of mergers and acquisitions that’s swept the FBO industry in the past five years. The deal, backed by a coalition between an outside investment firm and a posse of experienced aviation consolidators, is representative of the high interest from well-known investment groups in a formerly fragmented segment of the aviation industry. It also reflects a constantly shifting marketplace, where conglomerates of FBOs, some moderately sized and some colossal corporate chains, are finding a place on the map.

“The trading of multiple locations is at the highest level we’ve seen in 30 years of following the industry,” said Steve Dennis, chairman of Colorado-based Aviation Resource Group International, which advises and represents both regional chains like TAC Air, headquartered in Texas, and huge international operations like BBA Aviation, owner of Signature Flight Support. “It’s been a seller’s market, and it may continue to some degree, simply due to fewer properties coming on the market.”

Jeff Kohlman, a principal at Colorado-based Aviation Management Consulting Group, said that although the consolidation efforts that have occurred recently may be slowing down, opportunities are still there.

“AMCG estimates that there are still several hundred excellent FBO opportunities that have yet to be acquired, or may have already been acquired but will be flipped in another large transaction,” he said.

A Landmark transaction

Industry watchers have kept a close eye on the Encore/Landmark acquisition. Two financial backers accomplished the $436 million purchase of the FBO chain from United Arab Emirates-based Dubai Aerospace Enterprise. Chicago-based GTCR Golder Rauner, which controls more than $8 billion in capital investments, provided much of the funding. The consolidation experience came from Platform Partners, an experienced FBO management team largely comprised of former management from the sizeable Trajen operation, acquired by Atlantic Aviation in June 2006.

In 2007, DAE briefly retained ownership of Landmark as part of a $1.9 billion acquisition from The Carlyle Group. However, the U.S. Department of Justice required DAE to divest some of its assets. DAE sold its interest in Landmark’s FBO chains but retained its other assets.

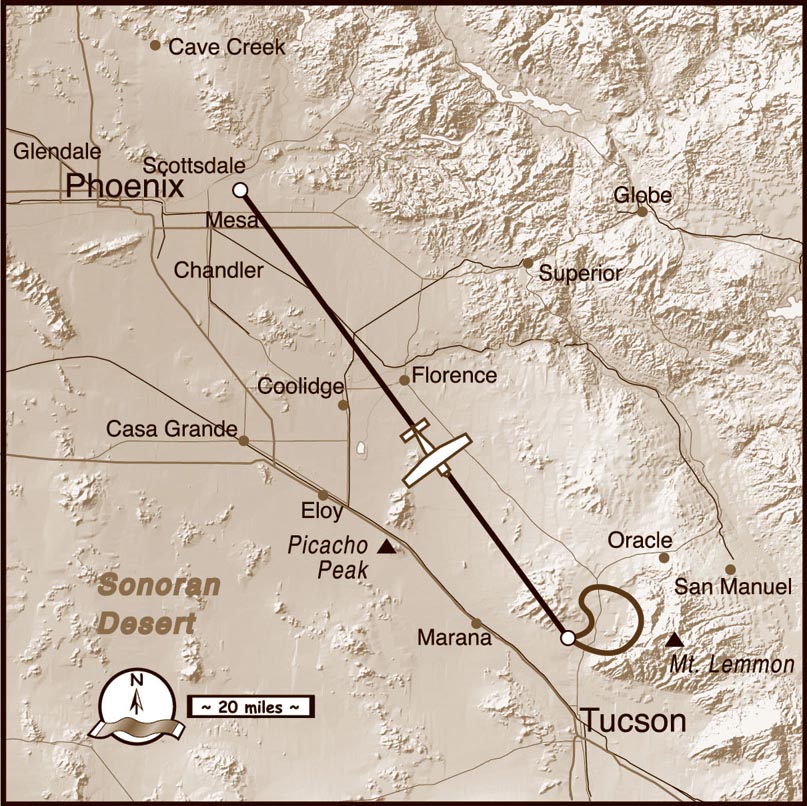

On March 3, Encore FBO LLC, GTCR and Platform acquired Landmark’s airport services division from DAE, which included 33 FBOs. With Encore’s existing eight facilities and Landmark’s 33, the company presently owns or manages 41 FBOs. Facilities are strategically located at airports in the U.S., Canada and Europe. Encore also owns DoD fueling and fuel support systems businesses.

Today, Landmark competes against Signature, with 61 locations in the United States, and Atlantic, as well as smaller FBO chains like Ross Aviation, TAC Air, jetCenters, Stevens Aviation, Elliott Aviation, Volo Aviation, SheltAir Aviation Services and Galaxy Aviation.

“I believe there’s an opportunity to enhance brand loyalty,” said Dan Bucaro, Encore’s president and CEO, who retains those titles with Landmark. “If you provide excellent customer service, with an equally strong safety record, that facilitates robust growth in the industry. If you’re in Paris, France, or Springfield, Ill., and can count on the same level of customer service, then we have an opportunity to expand Landmark’s brand loyalty.”

Bucaro said it’s not the number of locations that matter, but the quality.

Jeff Kohlman, a principal at Colorado-based Aviation Management Consulting Group, said that although the FBO consolidation efforts that have occurred over the last five years may be slowing down, opportunities are still there.

“It’s about finding the right places and determining the types of locations we want,” he said. “We’re not engaged in some kind of race to be the largest FBO chain in America. We absolutely believe in consolidation; we’ll actively acquire more locations this year and within the next number of years. But it’s not about putting dots on the map. These are strategic acquisitions; we ask ourselves if a location enhances our network and benefits our customers. It has to make sense.”

In addition to Bucaro, Landmark’s team now includes key personnel from Trajen, including former CFO David Barnes, who now leads Landmark’s integration team; Ted Hamilton, vice president of operations; and Tom Rowe, vice president of sales and marketing.

“We have a good mix of people from both inside and outside of the industry,” Bucaro said. “We have people who’ve been in aviation for 25 years and people like me, who’ve been in it for five years. This combination is effective, because people who’ve worked in the industry understand it intimately; we know how to consolidate and manage multi-site businesses globally.”

The untapped markets outside U.S. borders are of high interest to the growing company.

“Landmark currently has six locations outside of the U.S., including three in Canada and three in Western Europe,” Bucaro said.

He said the company is also looking to expand into strategic geographic locations domestically.

“We have some voids in the western United States, so we clearly have some interest in expanding into those markets,” Bucaro said. “We also love Western Europe. While it’s a smaller market, it’s growing in double digits. But it’s not a place you enter lightly, because it’s a different business model. In addition, we believe there are opportunities for us in the Middle East.”

The biggest challenge ahead of the company is integrating its data management platforms across 41 operations and building a 42nd FBO facility in Asheville, N.C., with construction beginning in mid-May.

“It’s one thing to integrate and provide our general managers with better systems, but we also give them real-time information so they can manage their businesses accordingly,” Bucaro said.

While Landmark is committed to supporting its managers, Bucaro said the position comes with great responsibility.

“They understand their own environment better than we do sitting here in Houston, so that autonomy is an important facet,” he said. “Our discounting structure gives them the flexibility to handle situations on the ramp that may come up. But they have to understand how an action they take with a customer affects the business. They have to run the business from the customer service and ramp perspective, while understanding the financial implications.”

Bucaro said he’s happy with how the company’s team has embraced this change.

“Not everyone will agree with the way we do things, but it will bring a sense of stability and demonstrates that we know how to build and operate a successful FBO network,” he said. “We’re investing our capital in our employees, equipment, facilities and other assets. That should prove to people that we’re going to be a dominant presence in the industry.”

Deals by the dozen

Investment companies, private and public equity funds, public companies, hedge funds, etc., are acquiring FBOs as quickly as possible, each vying for the best locations across the nation.

Hawker Beechcraft Corp. announced on Feb. 22 that it was selling seven of its fuel and line service operations (but keeping its maintenance service centers) to Signature. The $128.5 million acquisition, expected to close in May, makes BBA the largest FBO holding company with 115 facilities.

Steve Dennis, chairman of Colorado-based Aviation Resource Group International, said the trading of multiple locations is at the highest level the company has seen in 30 years of following the industry.

With 68 FBO locations, Atlantic nearly doubled its size in 2007 with the purchase of 24 facilities from Mercury Air Centers. Since the acquisition, it added FBOs at airports in New Jersey and San Jose and Santa Monica, Calif. In early March, Atlantic bought three FBOs from SevenBar Enterprises, located in Albuquerque and Farmington, N.M., and Sun Valley, Idaho. Lou Pepper, Atlantic’s CEO, said the company’s goal was to have FBOs scattered across California to grow its brand and offer customers with quality service.

Maguire Aviation Group LLC, backed by real estate mogul Robert F. Maguire III, purchased a few FBOs in California to test the waters—Skytrails Aviation in March and Petersen Aviation and Million Air Van Nuys in 2006. Maguire’s son, Alec, manages the facilities. Maguire, the largest leaseholder at Van Nuys Airport (VNY), is testing its business model that could potentially be franchised out to other airports.

Other chains entering new geographic markets include Connecticut-based Volo Aviation LLC, which in a single year has assembled a chain of five facilities, including Hayward Jet Center in California, NextFlight Aviation in Virginia, Rocket Man Jet Center in Texas and Volo Aviation Fort Pierce (formerly Fort Pierce Jet Center) and Jones Aviation in Florida. Brian Ciambra, vice president of Volo’s FBO division, said the company is about 16 months away from opening its sixth facility at Igor I. Sikorsky Memorial Airport (BDR).

“The new facility, Volo Aviation Bridgeport, will have about 15,000 square feet of FBO space with about 65,000 square feet of hangar space,” Ciambra said. “We’re still in the development process, but amenities will be state of the art.”

He said that by the first part of May, all facilities will have the same branding and personnel uniforms will sport the company’s black and blue V logo.

“For example, Rocket Man Jet Center’s signage is Volo Aviation Houston, etc,” he said. “This is what’s going on at all of our facilities. Although we’re a new company, we’re confident that our branding strategy will be highly successful. There’s a lot more to branding than publishing ads; we want customers to walk into any of our FBOs and experience the same high-quality service, knowing they’re dealing with people who have a sincere desire to provide that service.”

TAC Air, a division of Truman Arnold Companies, also rounded out its holdings to 12 facilities in 2007; its purchase of Southern Jet netted the company an FBO in Raleigh-Durham, N.C.

AMCG produced statistics for 2007 showing that the country has 3,359 FBOs at 3,330 airports, with a 3,000-foot or longer hard surface runway.

“While the number of these locations isn’t diminishing, the number of FBO companies is,” Kohlman said. “That type of consolidation, whether it’s large chains buying up small chains or single locations, is still the predominant side of the equation. I think over the next five years we’ll see a handful of transactions each year. But I think the multiple location transactions are going to come down this year due to most of these opportunities being acquired and the access to capital for high dollar (over $100 million) transactions.”

A hot investment

As evidenced in the Encore/Landmark merger, capital infusion makes or breaks consolidations. From Signature to Atlantic, investors seek FBO opportunities.

“There’s tremendous interest in new acquisitions from those who already own FBOs, whether it’s large companies or smaller operators,” Kohlman said. “There’s interest coming in from outside the industry, originating from people looking to make a big splash or make a really big acquisition in the industry. That interest is coming from both domestic and foreign investors.”

The attraction of the FBO market varies, as it depends on the company putting up the money.

Dan Bucaro said that Landmark’s aircraft sales, aircraft management charter service and maintenance repair operations represent less than 10 percent of the company’s business from a profitability standpoint and that acquisitions would support FBO business

“I think investment groups see a few things that they find attractive,” Dennis said. “They’re not making any more real opportunities for leasehold development. It’s a business that has high barriers to entry.”

He added that anyone who utilizes business aircraft knows if you’re flying to places airlines don’t service, using private jets and the FBOs that serve them creates a market.

“That necessity isn’t going away any time soon,” Dennis said.

The lack of opportunities to secure land at the nation’s primary airports and to develop full-service facilities has led to a realization on the part of investors. Companies putting money into a volatile business that depends largely on fuel prices are recognizing that FBOs have other commodities to offer besides gas pumps.

“Historically, we’ve seen fuel sales as the primary focus of FBOs,” Kohlman said. “Real estate has been a secondary activity—one that hasn’t been managed very well. A lot of the acquiring companies understand the value of real estate and the mechanics of getting fair market rates for real estate (and for fuel) and how that translates to the bottom line.”

Another contributing factor affecting the market is future opportunities to service new business and personal aircraft—namely the very light jet. The Citation Mustang and the Eclipse 500, VLJs that are currently flying, have sparked attention of both users and passengers. In 2008, with the Embraer Phenom 100 entering service, and subsequent years of other VLJ contenders entering the scene, the marketplace will change.

“VLJs are a rallying point that could further energize the industry,” Kohlman said. “The industry has yet to realize the impact of these aircraft.”

He said a critical question emerges from the projected number of corporate aircraft and VLJs that are slated for production in the future.

“Besides simply selling them fuel, where are you going to put those planes?” he asked. “That requires real estate.”

Advantages of consolidation

Companies like Encore understand the advantages of consolidation.

“Anybody can come in and buy a location or two if you have the capital,” Bucaro said. “It’s a question of whether you can operate them efficiently. The economies of scale come from your back office, and if you do it right, it’s seamless to a customer. As for the FBO side, it’s a quick cash business; equity investors like to see positive receivables.”

By operating multiple FBO networks, from five to hundreds, consolidators multiply their advantages by negotiating competitive prices for fuel, parts and other goods. In doing so, they consolidate management teams and present customers with more choices for servicing and fueling their aircraft.

“The trends that we’re seeing reflect a streamlining on the operating side of the business,” Dennis said. “The reason that some of these acquisitions have occurred is that there’s a large amount of back-office overhead that can be consolidated. Each operation would otherwise duplicate those efforts.”

He said the opportunity to save money is always a hot topic to operating managers.

“I think the pressures on margins and the need to maintain high service profiles at the same time, to be competitive in the marketplace, will continue,” he said. “It’s a challenge, but it’s an achievable one.”

Analysts and other industry observers are also seeing a return to the basic building blocks of the FBO business.

“In the past, FBOs were full-service operations with aircraft sales, flight training, charter, maintenance, real estate and fuel,” Kohlman said. “It wasn’t until the 1980s, when aircraft sales diminished, that these companies had to start looking at their core products and services—what they do best. Fuel, service and real estate have become the primary FBO business model.”

Landmark’s CEO admits that while its business is still diverse, the company’s areas of focus may be less broad than they’ve been in previous incarnations.

“We have two other divisions that include aircraft sales, aircraft management charter service and our maintenance repair operations,” Bucaro said. “Even though they’re significant in size as far as revenue, they represent less than 10 percent of our business from a profitability standpoint. Our acquisitions will be in support of FBO business.”

What’s next?

With 68 FBO locations, including this one in Houston, Atlantic nearly doubled its size in 2007 with the purchase of 24 facilities from Mercury Air Centers.

In communicating with individual FBO owners at aviation conferences, Dennis has observed some reluctance on their part to leap into the world of consolidation.

“Owners are seeing interest in their properties, but some are not interested in selling right now, because they have some challenges ahead in terms of profitability,” he explained. “Certainly margins are under pressure because of the 40 percent increase in fuel costs in the last eight months. Potential sellers interested in divesting themselves of their FBOs could generate a fairly high transaction value now, but in many cases, they feel they have more work to do.”

Selling out could eventually become an opportunity that’s hard to ignore for private owners facing retirement.

“A lot of individual owners don’t have plans for succession in place,” Bucaro said. “The owners love aviation, but their kids might not. It’s a different situation with every business.”

Analysts are watching closely to see which companies are demonstrating a long-term strategy and which may come and go. Kohlman said there’s definitely a lot of money being made in buying FBOs and then flipping them in a short amount of time.

“Some entities have a five-year cycle window; some groups are in this business indefinitely,” he said. “Signature is in it for the long haul. It’s yet to be seen if Macquarie has an exit strategy, because it doesn’t hold its investment, Atlantic Aviation, in a timed fund that would force a sale.”

Kohlman also believes that for companies as large as Macquarie, it might be easier to amalgamate other chains than to bother integrating individual locations.

“I believe it’s much easier for Macquarie to do a $300 million transaction for multiple locations than a whole bunch of $10 million transactions,” he said. “It’ll let smaller groups do the hard and dirty work of bringing these businesses together, synergizing them and getting the transactions done. Then it can do one transaction. It’ll be interesting to see if that happens.”

He said that opportunities are shrinking in the primary markets—GA airports that consistently post high traffic numbers and boast proximity to the country’s most influential business centers—but makes a prediction.

“We’ll see more interest in the markets that companies like Macquarie and Signature aren’t so focused on,” he said. “That could mean a resurgence of secondary markets realizing real estate potential, as there’s still land available. I think we’ll see situations occur where satellite airports are developed and then aircraft are ferried into position, as needed.”

No matter how the market develops, it’s likely to be a new generation of aviation-savvy professionals who influence how and where aircraft owners buy fuel and services.

“The biggest pitfall of the past was that people who hadn’t been in the business before tended to oversimplify investments, not realizing how complex and challenging this business is,” Kohlman said. “Neophytes quickly learn the old lesson: the aviation industry has made millionaires out of multimillionaires.”